All about crypto currency

The best trading platform depends on your specific needs and preferences. Beginners will do well with Robinhood’s user-friendly interface, while more advanced traders should look at analysis options and trading options to choose the platform that’s right for them lucky tiger casino legit.

At its heart, cryptocurrency trading involves buying and selling cryptocurrencies, just like any other trading you might know of, such as stocks, commodities and forex. Traders aim to make money by guessing the price movements of volatile digital assets. They exchange fiat money or other digital assets for cryptocurrencies on a crypto exchange and typically buy when the cryptocurrency’s value is low and sell when it peaks.

To be a profitable trader, you will need a suite of applications from data portals and news aggregators to portfolio trackers. They all work in tandem to offer you real-time data you can use to make better trading and investment decisions.

All about crypto mining

As more companies design cutting-edge mining chips catering to hobbyists and small independent miners, the playing field becomes more level versus large conglomerates. Commoditized access to advanced mining rigs benefits decentralization. More open competition squeezes incumbent giants relying on proprietary hardware access.

Mining profitability varies based on electricity costs, hardware efficiency, and cryptocurrency market conditions. Always do thorough research before starting, especially if you’re a beginner. Additionally, consider the specific guidelines provided by the cryptocurrency you intend to mine, as each may have unique requirements and recommendations.

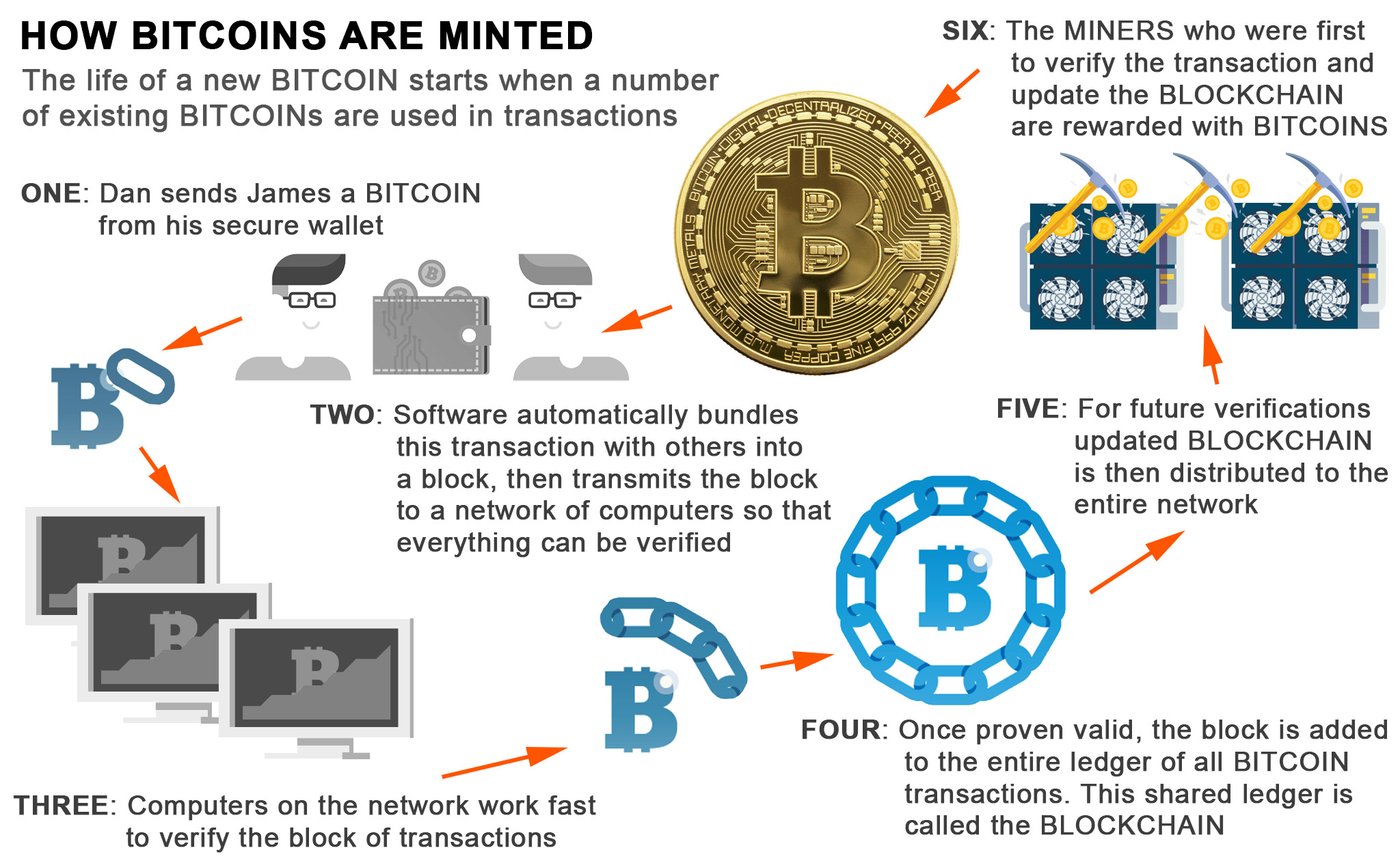

Mining is a complex process, but in a nutshell, when a transaction is made between wallets, the addresses and amounts are entered into a block on the blockchain. The block is assigned some information, and all of the data in the block is put through a cryptographic algorithm (called hashing). The result of hashing is a 64-digit hexadecimal number, or hash.

Mining pools are groups of miners who pool their resources (hash power) to increase their chances of winning block rewards. When the pool successfully finds a block, the miners in the pool share the reward according to the amount of work they each contributed.

The competitive incentive to mine will disappear, with only the transaction fees remaining as a reason to participate in Bitcoin’s network. Some miners might still participate as a way to take part in a decentralized currency, but it’s likely that without the reward, most will not want to mine. That is, unless the fees increase enough to make it worth their while.

Anyone with an Internet connection and enough computing power to compete with other miners can choose to mine for cryptocurrency. Crypto mining is decentralized by nature, which supports the security of a proof-of-work blockchain. (Learn more about decentralized public ledger technology and consensus mechanisms.)

All i need to know about crypto

Cryptocurrencies are fungible, meaning the value remains the same when bought, sold, or traded. Cryptocurrency isn’t the same as non-fungible tokens (NFTs) with variable values. For example, one dollar in crypto will always be one dollar, whereas the value of one NFT dollar depends on the digital asset it’s attached to.

While you can hold traditional currency in a bank or financial institution, you store cryptocurrencies in a digital wallet. Banks insure money kept in bank accounts against loss, while crypto has no recourse in the event of a loss.

In communities that have been underserved by the traditional financial system, some people see cryptocurrencies as a promising foothold. Pew Research Center data from 2021 found that Asian, Black and Hispanic people «are more likely than White adults to say they have ever invested in, traded or used a cryptocurrency

With cryptocurrencies, on the other hand, discerning which projects are viable can be more challenging. If you have a financial advisor who is familiar with cryptocurrency, it may be worth asking for input.

is another way of achieving consensus about the accuracy of the historical record of transactions on a blockchain. It eschews mining in favor of a process known as staking, in which people put some of their own cryptocurrency holdings at stake to vouch for the accuracy of their work in validating new transactions. Some of the cryptocurrencies that use proof of stake include Cardano, Solana and Ethereum (which is in the process of converting from proof of work).